Graphic paper demand continues to decline

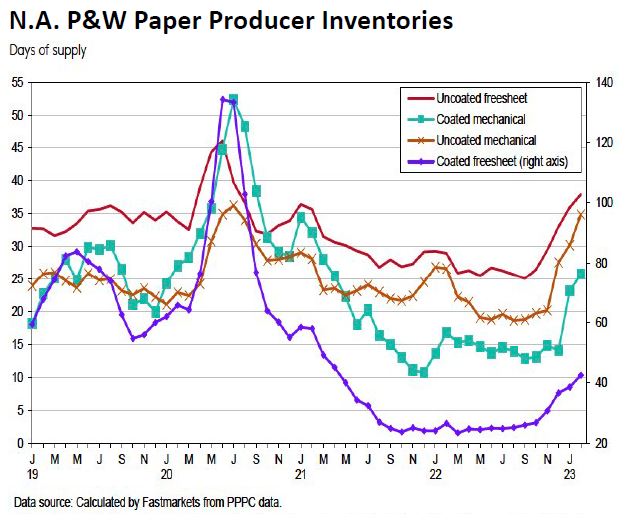

Graphic paper demand continued to be weak in March as printers and end users were still working through their inventories. As a result, paper mills continued to adjust production by extending planned maintenance downtime or taking extra downtime. Total US printing and writing paper shipments declined 12.2% in February over January, to 572,700 tons, according to AF&PA statistics. This number is 15.3% lower compared with February 2022. Demand fell by just 7.3% month-over-month and by 6.4%year-over-year indicating that capacity reductions continue to outpace demand declines. This is further evidenced by the fact that pricing for UFS,CFS, and CM grades in the North American market remained unchanged in March. It is expected that pricing will remain unchanged in April also as mills continue to take downtime in an effort to control supply and hold prices up. Two expected capacity reductions in Q2 – the PM26 conversion at ND Paper’s Biron mill and Pactiv Evergreen’s closure of its Canton, NC mill – will also help support current elevated pricing levels.

Stora Enso concludes sale of Hylte mill in Sweden

Stora Enso has announced the conclusion of the Euro 18 million ($19.6million) sale of its 245,000 tonne/yr Hylte, Sweden, newsprint mill. The buyer is Sweden Timber, a new entrant to the paper industry, which runs four sawmills across the country. According to Stora Enso, Sweden Timber will continue paper production at the site and take over sales to existing customers. With this sale the company has concluded the paper production reorganization it announced in early 2022. Stora reiterated that its strategic focus remains on packaging, building solutions and biomaterials.

First half of 2023 to see 1.6 million tons of P&W paper capacity come out

Capacity reductions continue unabated in both Europe and North America as the market continues to adjust to declining demand. The following shuts and conversions have either happened already or will occur by the end of June:

- Evergreen: Canton, NC mill closure: 237K tpy of UFS

- ND Paper: Biron, WI machine conversion: 225K tpy of CGW

- Norske Skog: Golbey, France machine conversion: 260K tpy of Newsprint

- Burgo: Duino, Italy mill sold to Mondi, converting PM3: 220K tpy ofCGW

- UPM: Schongau, Germany mill shutting PM6: 187K tpy of UM

- UPM: Steyrermühl, Austria mill sold to Heinzel: 77K tpy of UM and320K tpy of Newsprint

- Kübler & Niethammer: Kriebstein, Germany mill closure: 83K tpy ofCGW and 22K tpy of UM